According to the North American Securities

Administrators Association (NASAA), free meal seminars

conducted by people with questionable credentials to sell legal and/or investment

products to older adults create a “perfect storm” for investment fraud. Ever since

I turned 50, invitations have arrived for “free lunch” or “free dinner”

seminars.

I always wanted to attend one undercover, but too many people in my

New Jersey county knew me from my Rutgers Cooperative Extension job and/or newspaper column. The

invitations typically say “No Brokers. Agents, or Advisers” and it was well

known that I hold the CFP® credential.

Now that I am an entrepreneur in Florida

and few people know me, I decided it was high time to check out a “free dinner”

seminar incognito. Unlike Helaine Olin’s undercover experience as described in Pound

Foolish, where her free meal arrived very late, this presentation lasted

only 45 minutes before a buffet was served. Below are some “Barbservations”:

¨

The speaker

covered content for about 25 minutes and promoted his firm’s services for 20

minutes. The old saying “There is no such thing as a free lunch” (or dinner)

holds true here. Expect to sit through an extensive sales pitch.

¨

The PR flyer

listed 11 seminar topics. About half were touched upon with little time for

participant questions. Big scary numbers (cost of a year of nursing home care) and

“shocking statistics” (their PR flyer words; e.g., chances of needing long-term

care) were the focus. They wanted people to leave scared and seeking help; not

empowered with information.

¨

The speaker called

himself a “specialist,” had no financial credentials such as CFP®, and

distributed no handouts. His company name was not listed on the PR flyer. To

win a door prize, participants had to return a completed contact sheet. I

wonder how many of the 100 or so people who attended really filled it out. Personally,

I left the address section blank and listed my old disconnected New Jersey

house phone number and a “junk” e-mail address. Lots of luck finding me.

¨

There were several

useful take-aways including a common error of older adults: “believing that

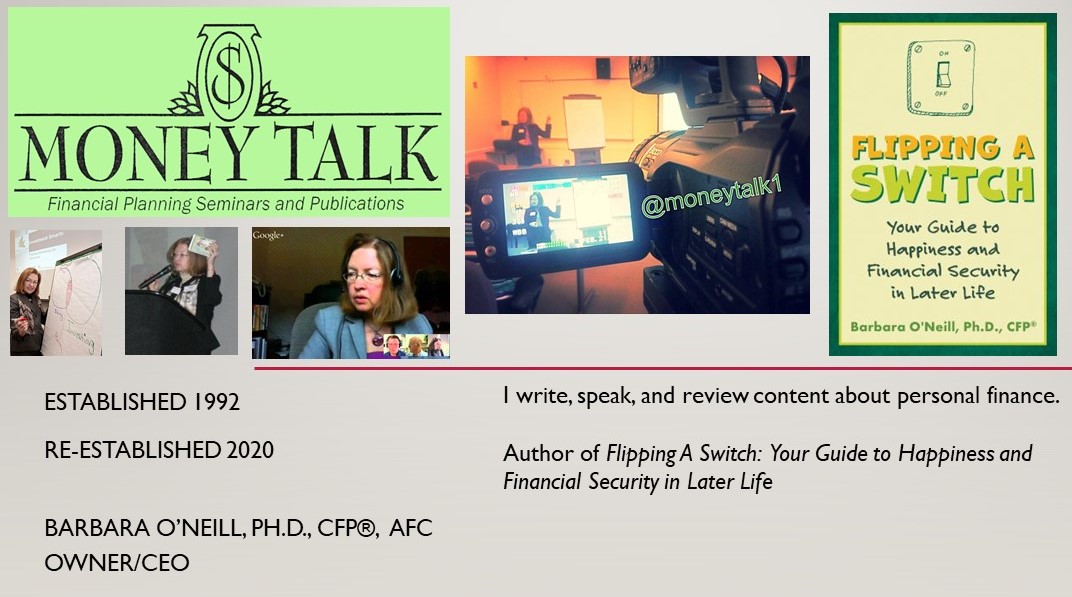

life will always look the way it does today.” I put that in my forthcoming

book. There was also a useful discussion of the biggest fears of retirees

including: running out of money, steep market declines, higher taxes, loss of a

spouse, and health and long-term care.

Attend “free meal” seminars with caution. NASAA provides the

following tips: check out strangers touting unfamiliar products (the seminar mentioned

a “hybrid annuity with an income benefit rider”), watch out for salespeople who

prey on your fears, don’t make rash decisions, and ask tough questions. If

something sounds too good to be true…you know the rest.