Yes,

I have been counting. This weekend completes 20 weeks of living with COVID-19

uncertainty on so many fronts. I count my blessings that I am healthy, busy

with multiple work projects, and mostly financially unscathed and continue to Work,

Walk, Write, and watch Webinars (and television news). Below are key

take-aways from some recent programs that I attended:

¨

There May Be Silver

Linings- Some people have spoken positively

about “taking a pause” from their previously hectic lives, spending quality

time with their family, and savoring a break from their daily commute. They may have even

vowed to not go back to their previous lifestyle and consider the pandemic to

be a life-changing event. Unfortunately, for many other people, COVID-19 has had few, if any, silver linings.

¨

Cash is King- The hard reality is that about half of American

households do not have three months of expenses saved. Nevertheless, many experts

are now saying that 3 to 6 months of expenses is not enough and that 6 to 9

months of expenses is a better goal to shoot for. My take: any savings is

better than none and the more money you can save, the larger the buffer you

will have.

¨

Estate

Planning is Salient- With 145,000+

COVID-19 deaths, interest in getting one’s “affairs in order” is growing,

especially among essential workers and teachers. A big stumbling block for parents

with minor children is who to name as a guardian. If you are at an impasse,

reach out to your attorney for guidance instead of delaying the preparation of a

will any further.

¨

Volatility Needs

a Hedge- Many financial planners

recommend that retirees have at least two years of expenses that are not

covered by Social Security, a pension, and/or an annuity in liquid (cash)

assets (e.g., a money market fund) to avoid withdrawal from stocks during

market downturns. Shop around to get the highest return on savings possible (e.g.,

online banks).

¨ Auto Insurance is Negotiable- Experts suggest calling your insurance company and

negotiating a lower rate if you are no longer using your car to commute or if

you are having trouble paying premiums. You may also want to increase policy deductibles

or shop around for a new policy. Whatever you do, do not let your insurance policy

lapse.

¨ Certainty is Not Possible- Experts recommend challenging your need for certainty.

With many aspects of COVID-19, there are no definitive answers and irrational

fears can lead to illogical thinking. Identify your “uncertainty triggers”

(e.g., social media, anxious friends and family, lack of sleep), learn to embrace

ambiguity, and focus on the present.

¨ Budgets Increase Financial Control- In times of reduced or volatile income, a budget can

be a financial lifesaver. Aim for a “zero-based budget” where income minus

expenses = 0. A budget is not a “one and done” static event. Rather, it is a

living and fluid document that needs to change as the circumstances in our lives

change.

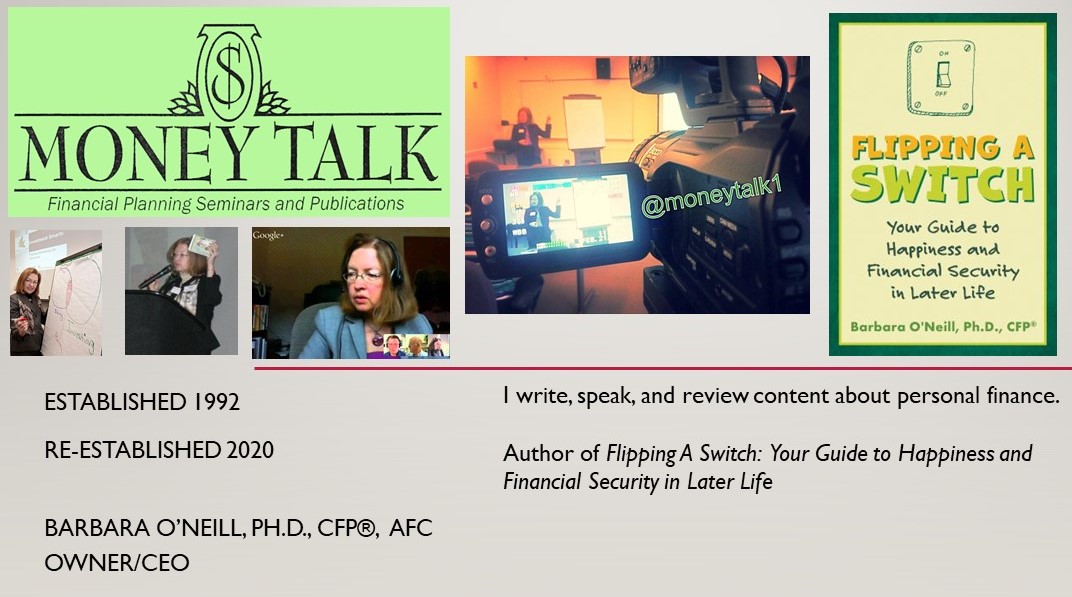

One last thing… print copies of my new book, Flipping a

Switch, will drop on Monday, August 3. E-books for Kindles are available right

now. For further information about the content of my book and how to order it,

visit the web page for

Flipping a Switch on Amazon.