As I wrote in an earlier post about entrepreneurship during a pandemic, paying attention to social media can really

pay off in making or solidifying valuable career contacts and obtaining job

assignments. For people interested in making professional connections, LinkedIn

is “the” place to be. No personal vacation photos here. It is all about

business and is a “digital resume” for people to learn about your skills and

past job experiences.

After a decade of scarcely paying attention to my LinkedIn account

because I was happy at Rutgers University and constrained by state outside

employment rules, I started posting

regular LinkedIn content for the first time ever when I became

a full-time entrepreneur in January 2020. This resulted in dozens of “people

are watching you” and “You appeared in

“X” number of searches” notifications from LinkedIn, inquiries about my work,

and projects with five new clients over the past 18 months.

According to a recent Next Gen Personal

Finance (NGPF) webinar, LinkedIn is the most widely-used information search

channel for job recruitment efforts (77%) followed by Facebook (63%). It has

738 million global users, 14 million job postings, and 3 people hired every

minute via LinkedIn connections. It is estimated that up to 40% of employers

may not interview you at all if they cannot find your LinkedIn profile.

LinkedIn allows people to “stand out

from the crowd” and share information well beyond what is found in a standard

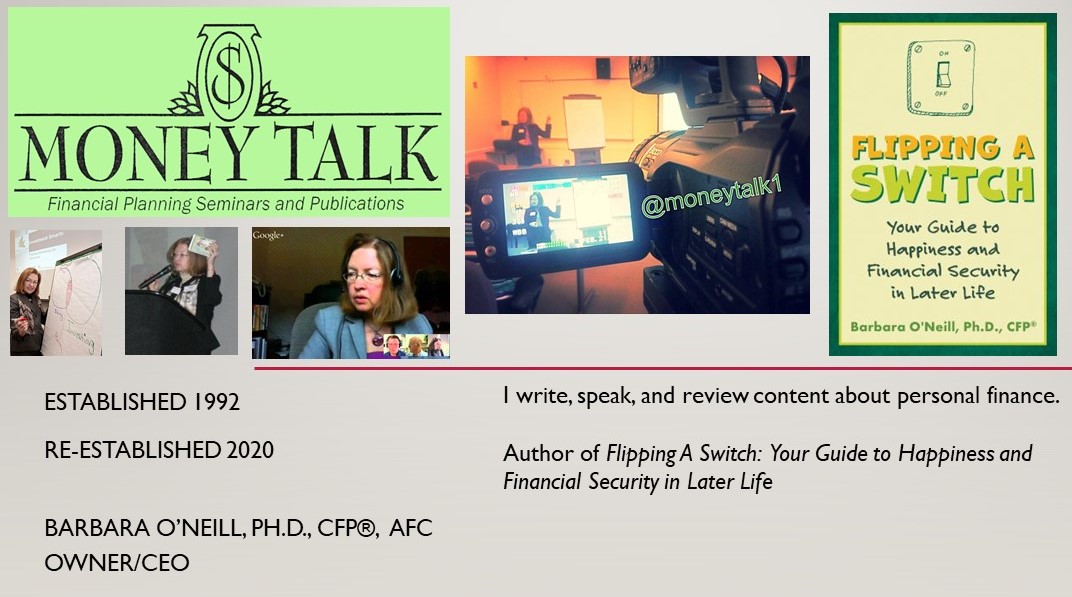

paper resume. For example, photographs of professional achievements and links

to websites, webinars, podcasts, blog posts, TED talks, and newspaper,

magazine, radio and television interviews. Digital links to deliverables also

show potential contacts or employers that you are both tech savvy and

accomplished.

Below are five key things to know about

using LinkedIn:

¨

Image is Everything- Three key

parts to a LinkedIn user’s profile are 1. a professional high resolution head

shot photo that is cropped appropriately to fit within a circle frame, 2. an

eye-catching headline of up to 120 characters (this goes right under a person’s

photo and name and is the first thing that people read), and 3. A well-written summary

profile under the “About” section. The profile should succinctly describe an

account holder’s skill set and accomplishments. A professional-looking background

banner photo is also recommended.

¨

Connection Numbers Matter- According to

an article that I read during the

NGPF webinar, the more connections that someone has on LinkedIn (this is the

professional equivalent to having Friends on Facebook and Followers on

Twitter), the more likely you are to be found by colleagues, job recruiters,

and people interested in your work. The “holy grail” is to have a notation of

500+ connections, which the maximum number that LinkedIn reports. Having 500+

connections indicates to others that you are a “serious player.”

¨

Connections Themselves Matter- The best connection

requests come from people you know professionally or have worked with. Unless

you have had “issues” in the past, this is an easy ask. The worst connection

requests are “cold calls” from people you do not know who do not explain who

they are, what they do, how they know you (e.g., from an article that you

published), and why they want to connect with you. Generally speaking, seek out

the former and avoid the later, especially if there is a “sales pitch” within

their connection request.

¨

Customize

Your LinkedIn URL- Experts

recommend doing this so you are more easily searchable. The process is very

easy. Simply click on “Edit public profile and URL” to the right of the header

photo. You will be prompted to enter a customized URL that cannot include

spaces, symbols, or special characters. If your URL is “taken,” you will be

prompted to retry with a new name. Instead of a URL with random numbers, my new

URL includes my name and company name (see https://www.linkedin.com/in/barbaraoneillmoneytalk/).

¨

Post

Content Regularly- The

article that I cited above suggests posting on LinkedIn at least 3 times per

week. This includes sharing content by writing articles as well as engaging

with other LinkedIn users through likes, comments, and shares. The objective is

to be visible, add value by providing useful resources to your connections, and

create an impression that you are an active and productive professional. In

addition, follow cues from LinkedIn to keep adding details to your profile

until you achieve an “All Star” rating.